Overview

This article underscores the pivotal role a fractional CFO can play in enhancing the operations and profitability of wine businesses through a range of strategic initiatives. By leveraging financial expertise in critical areas such as:

- direct-to-consumer sales

- cash flow management

- equity funding

wine producers are positioned to optimize their marketing efforts, bolster customer loyalty, and secure essential capital for growth. These strategic moves not only facilitate immediate improvements but also pave the way for sustainable success in an increasingly competitive market. The insights presented here are designed to empower decision-makers in the wine industry to take decisive action towards achieving long-term profitability.

Introduction

In the competitive landscape of the wine industry, the role of a fractional CFO stands out as a transformative force for vineyards aiming to enhance their business strategies. By leveraging specialized financial expertise, wineries can unlock innovative direct-to-consumer (DTC) approaches that not only boost sales but also foster enduring customer loyalty. Yet, with a multitude of options at their disposal, how can vineyards effectively utilize the insights of a fractional CFO to navigate challenges and capitalize on growth opportunities? This article delves into ten impactful strategies through which a fractional CFO can revolutionize a wine business, securing its prosperity for generations to come.

Enocap: Enhance Direct-to-Consumer Sales Channels

A fractional CFO for wine business plays a pivotal role in helping vineyards identify and implement effective direct-to-consumer (DTC) sales strategies. This involves a thorough analysis of customer data to tailor marketing efforts, optimize e-commerce platforms, and enhance customer engagement through personalized experiences. By leveraging analytics, vineyards gain valuable insights into consumer preferences, allowing them to adjust their offerings accordingly.

Establishments that tailor their marketing communications experience a significant increase in customer loyalty and sales. In fact, 39% of DTC sales stem from wine club purchases, underscoring the importance of launching wine clubs or subscription services to drive recurring revenue and foster community and brand loyalty. Enocap's proven strategies can convert casual buyers into devoted club members, ensuring sustainable advancement in DTC channels.

Furthermore, enhancing e-commerce platforms is vital; businesses that capture emails effectively can sell 78 cents online for every dollar sold in their tasting rooms, compared to just 18 cents for those with lower capture rates. Notably, the leading 10 producers collect emails approximately 69% of the time, emphasizing the necessity of a strong digital presence and tailored marketing to enhance engagement and revenue growth.

Additionally, addressing shipping costs is crucial, as they significantly impact cart abandonment rates, further complicating the optimization of e-commerce platforms. Lastly, incorporating storytelling into marketing efforts can enhance customer engagement, making personalized experiences even more effective in building loyalty.

By concentrating on these transformative DTC strategies, wine producers can secure the right capital with the assistance of a fractional CFO for wine business and flourish for generations.

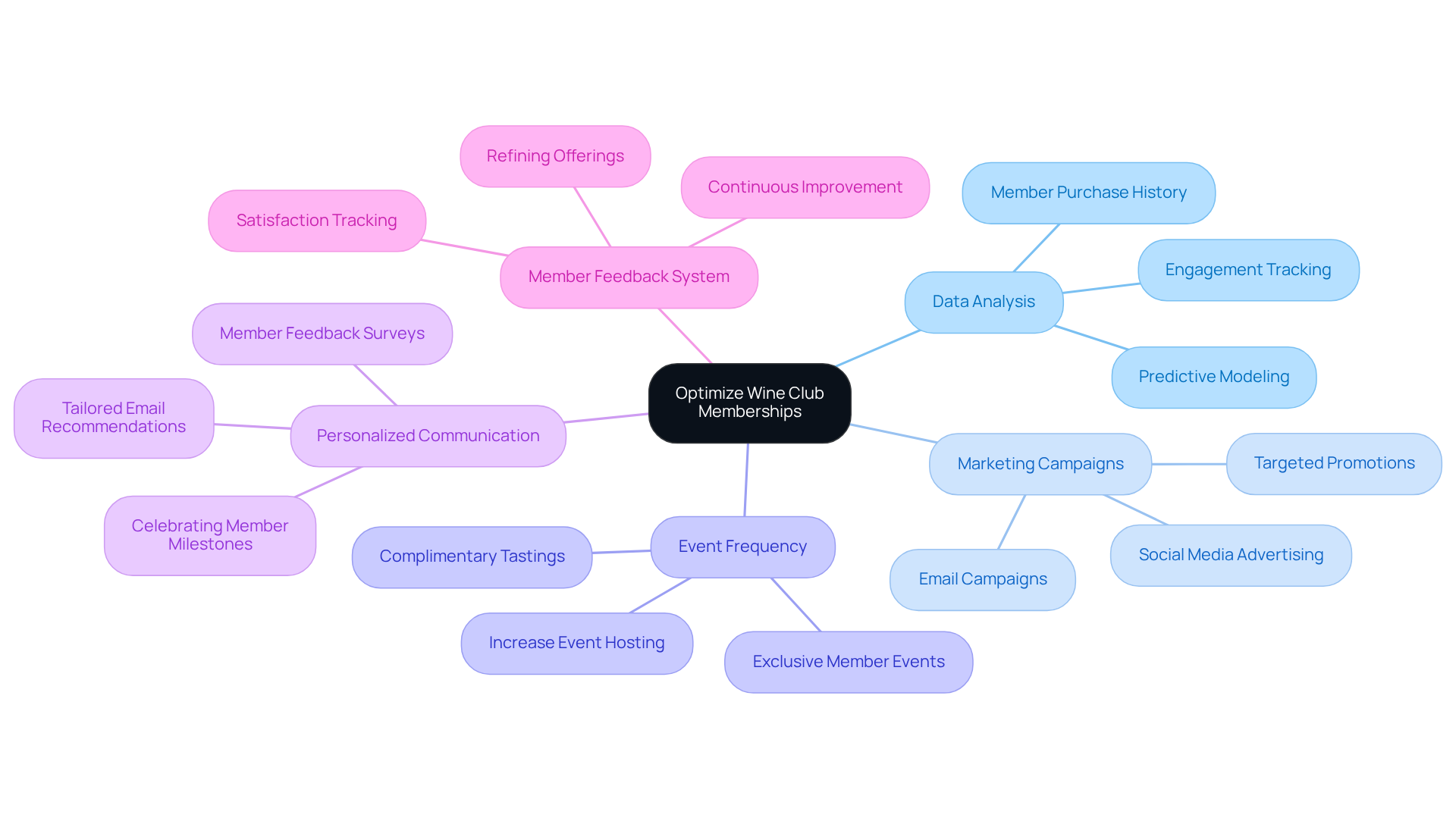

Optimize Wine Club Memberships for Increased Loyalty

A fractional CFO for wine business is essential for vineyards that aim to analyze membership data to uncover trends and preferences among club members. This data-driven approach enables vineyards to implement targeted marketing campaigns that resonate with their audience, thereby enhancing member benefits and creating exclusive events that foster loyalty. Notably, wineries that increase event frequency beyond the average of just one event per year can significantly boost engagement and conversion rates.

Financial modeling is critical for predicting income from wine clubs, allowing producers to prepare for sustainable growth and address cash flow challenges with the assistance of a fractional CFO for wine business. This proactive strategy ensures that vineyards can adapt to seasonal demands, such as the notable increase in white wine sales during May. To effectively enhance retention rates and attract new sign-ups, establishments should prioritize personalized communication and member experiences.

By transforming their wine club into a thriving community through established DTC methods, producers can strengthen loyalty and improve overall member satisfaction. As a practical tip, consider implementing a member feedback system to continuously refine offerings and engagement. Furthermore, Enocap's strategic capital advisory services can unlock growth opportunities, ensuring that family-owned vineyards thrive for generations.

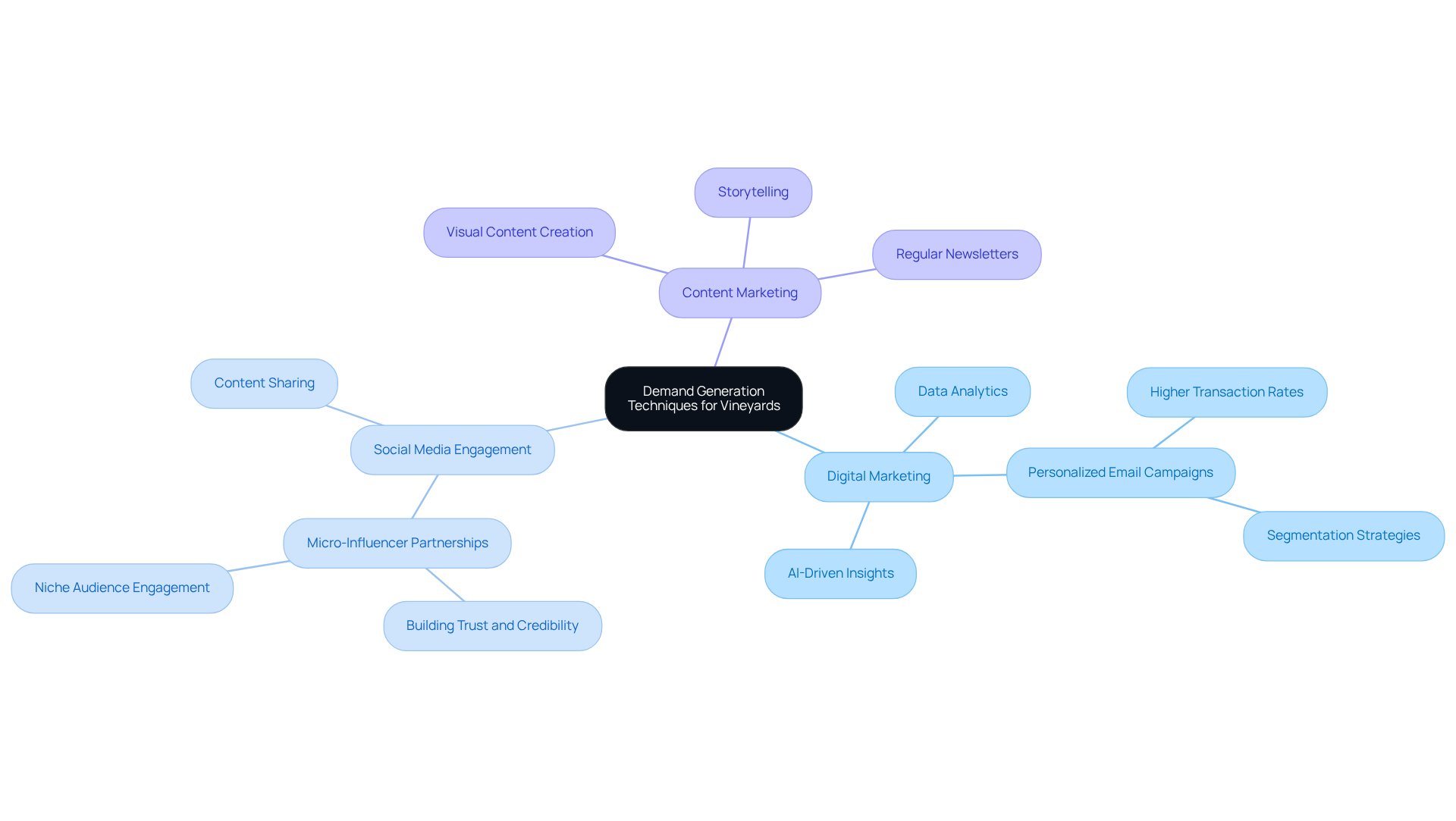

Implement Effective Demand Generation Techniques

A fractional CFO for wine business is instrumental in guiding vineyards to develop robust demand generation strategies that encompass digital marketing, social media engagement, and content marketing. By leveraging data analytics, vineyards can evaluate the effectiveness of various marketing channels, allowing for more strategic resource allocation. This data-driven approach not only drives sales but also significantly enhances brand visibility in a competitive landscape. For instance, personalized email campaigns can achieve transaction rates six times higher than generic emails. Moreover, 87% of buyers believe social media influences their purchasing decisions.

Furthermore, integrating micro-influencer partnerships can authentically link wine producers with niche audiences, building trust and credibility. By embracing these efficient digital marketing methods and concentrating on converting occasional purchasers into dedicated club members through established strategies, vineyards can enhance their return on investment, cultivate long-term customer loyalty, and unleash consistent DTC revenue expansion. Additionally, incorporating strategic capital planning for debt, equity, or acquisition opportunities can further enhance the contributions of a fractional CFO for wine business.

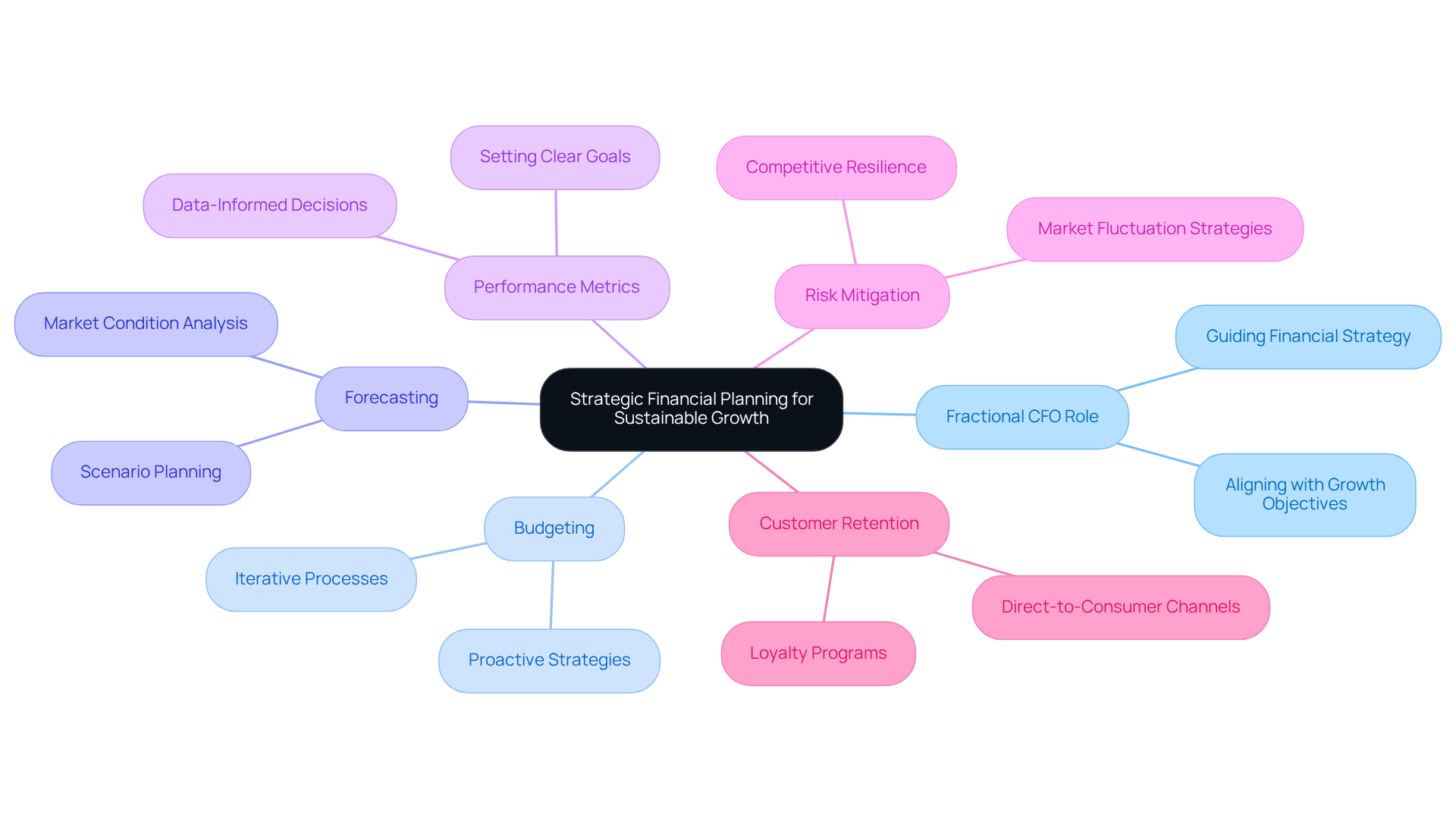

Strategic Financial Planning for Sustainable Growth

A fractional CFO for wine business is instrumental in guiding vineyards to develop a comprehensive financial strategy that aligns with their growth objectives. This role encompasses meticulous budgeting, precise forecasting, and strategic scenario planning to adeptly navigate fluctuating market conditions.

By setting clear financial goals and performance metrics, vineyards can make data-informed decisions that foster sustainable growth and enhance profitability with a fractional CFO for wine business. Financial advisors emphasize that a proactive budgeting strategy can significantly mitigate risks associated with market fluctuations, ensuring that businesses remain competitive and resilient.

As John Williams, owner of Frog’s Leap establishment, aptly states, "A weakened distributor network may paradoxically hurt domestic producers," underscoring the necessity of robust financial strategies in uncertain times. Successful vineyards frequently implement iterative budgeting processes, often utilizing a fractional CFO for wine business, allowing for adjustments based on real-time data and market feedback—this adaptability is crucial in an industry grappling with challenges such as oversupply and shifting consumer demands.

Furthermore, by establishing sustainable direct-to-consumer channels and transforming casual purchasers into loyal club members, producers can secure reliable DTC revenue. Leveraging established methods for customer retention and strategic capital planning can unveil growth opportunities, ensuring enduring success and the capacity to capitalize on emerging market trends.

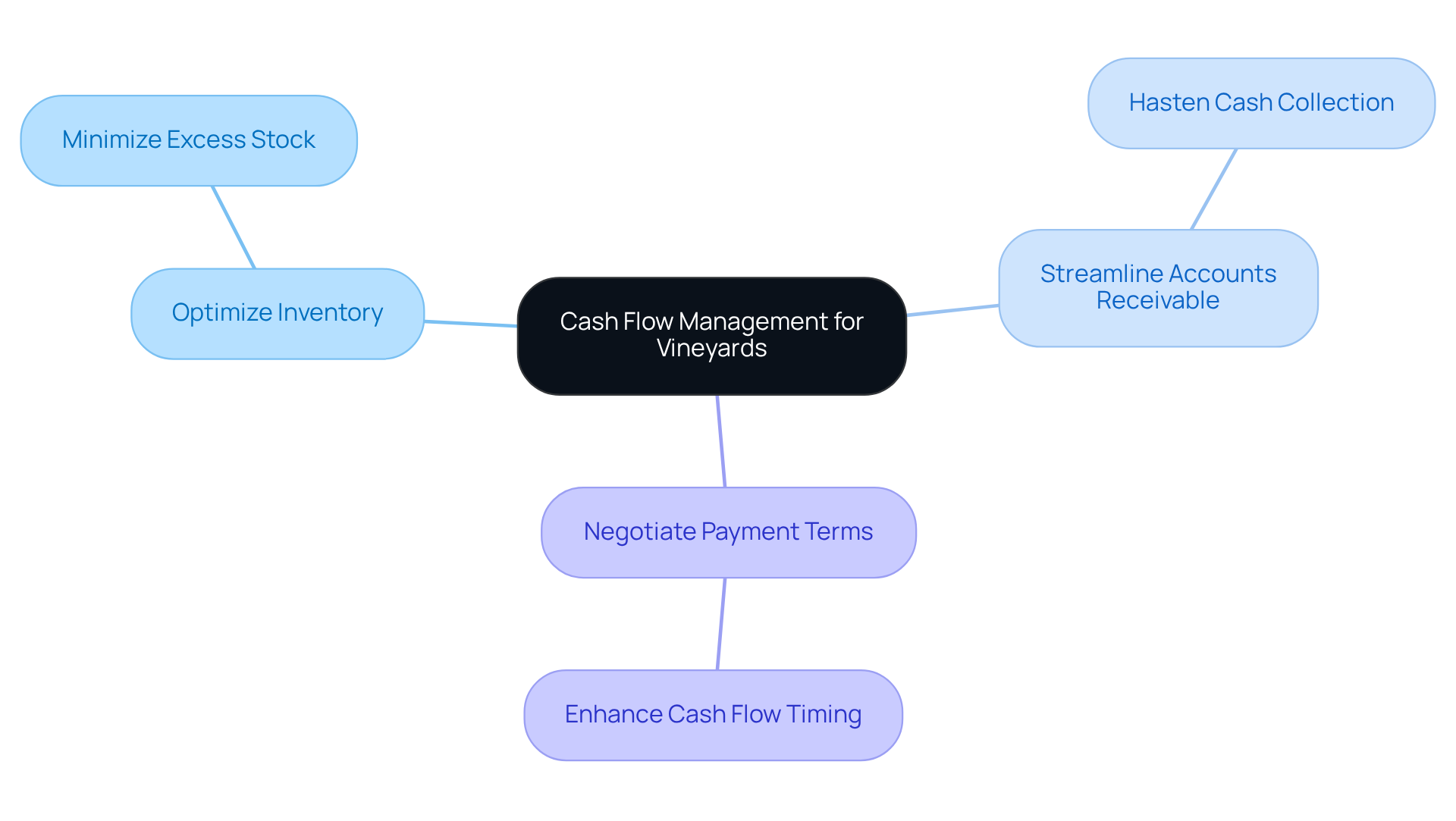

Improve Cash Flow Management with Expert Guidance

A fractional CFO for wine business is essential in assisting vineyards to enhance their cash flow management techniques, which is a critical factor for implementing transformative direct-to-consumer (DTC) strategies. By performing a comprehensive analysis of cash inflows and outflows, they can identify potential bottlenecks and apply targeted strategies to improve liquidity. Key methods include:

- Optimizing inventory levels to minimize excess stock

- Streamlining accounts receivable processes to hasten cash collection

- Negotiating favorable payment terms with suppliers to enhance cash flow timing

Statistics reveal that cash flow bottlenecks pose a significant challenge in the wine sector, with approximately 60% of producers facing cash flow issues during peak production periods. By leveraging expert guidance from a fractional CFO for wine business, such as Enocap's strategic capital consulting services, vineyards can ensure they fulfill financial obligations while simultaneously investing in growth opportunities. This proactive approach not only stabilizes cash flow but also empowers producers to seize emerging market trends, including the rising consumer demand for premium wines and sustainable practices.

With consumers increasingly willing to invest in unique varietals, effective cash flow management is vital for achieving long-term success in an evolving industry. Furthermore, by establishing sustainable DTC channels and transforming casual purchasers into loyal club members, vineyards can generate consistent income and enhance customer loyalty, ultimately uncovering expansion opportunities through tailored capital solutions.

Access Specialized Financial Expertise for Better Decision-Making

A fractional CFO for wine business provides invaluable expertise, empowering vineyards to adeptly navigate the complexities of economic decision-making while unlocking transformative direct-to-consumer (DTC) strategies. This role is essential in evaluating investment opportunities, where a deep understanding of market dynamics can significantly influence outcomes. Historical data reveals that fine wine has provided an average annual return of 4.1% in real terms, while a wine portfolio has yielded an impressive average of 8.76% annualized returns over every five-year period from 2004 to 2024, establishing it as a compelling asset class for long-term investment. By leveraging the insights of a fractional CFO for wine business, vineyards can more effectively assess monetary risks and devise robust strategies for capital distribution, particularly in establishing sustainable DTC channels that foster steady growth and convert casual purchasers into devoted club members.

In today's market landscape, where the fine wine sector constitutes approximately 1-2% of the $450 billion global wine market, making informed decisions is paramount. The market has encountered challenging conditions over the past 18-24 months, with prices declining by 10-20%. A fractional CFO for wine business can assist vineyards in identifying high-potential investments and optimizing their portfolios, particularly during these turbulent periods of market fluctuation. As Paul Hammond, co-founder of Lay & Wheeler Trading, underscores, understanding market dynamics is crucial for collectors and investors alike, directly impacting their decision-making processes.

Moreover, the ability to critically assess investment opportunities can lead to enhanced economic performance. With the right guidance, vineyards can align their economic strategies with long-term objectives, ensuring sustainable development and resilience in an ever-evolving sector. This strategic oversight not only aids in immediate decision-making but also cultivates a culture of fiscal responsibility that can benefit vineyards for generations. Additionally, a fractional CFO for wine business can facilitate the diversification of investment portfolios and secure the appropriate capital for debt, equity, or acquisition opportunities, further mitigating risks and bolstering overall financial stability. To effectively convert casual purchasers into dedicated club members, establishments should implement targeted marketing strategies, personalized customer experiences, and loyalty programs that resonate with their audience.

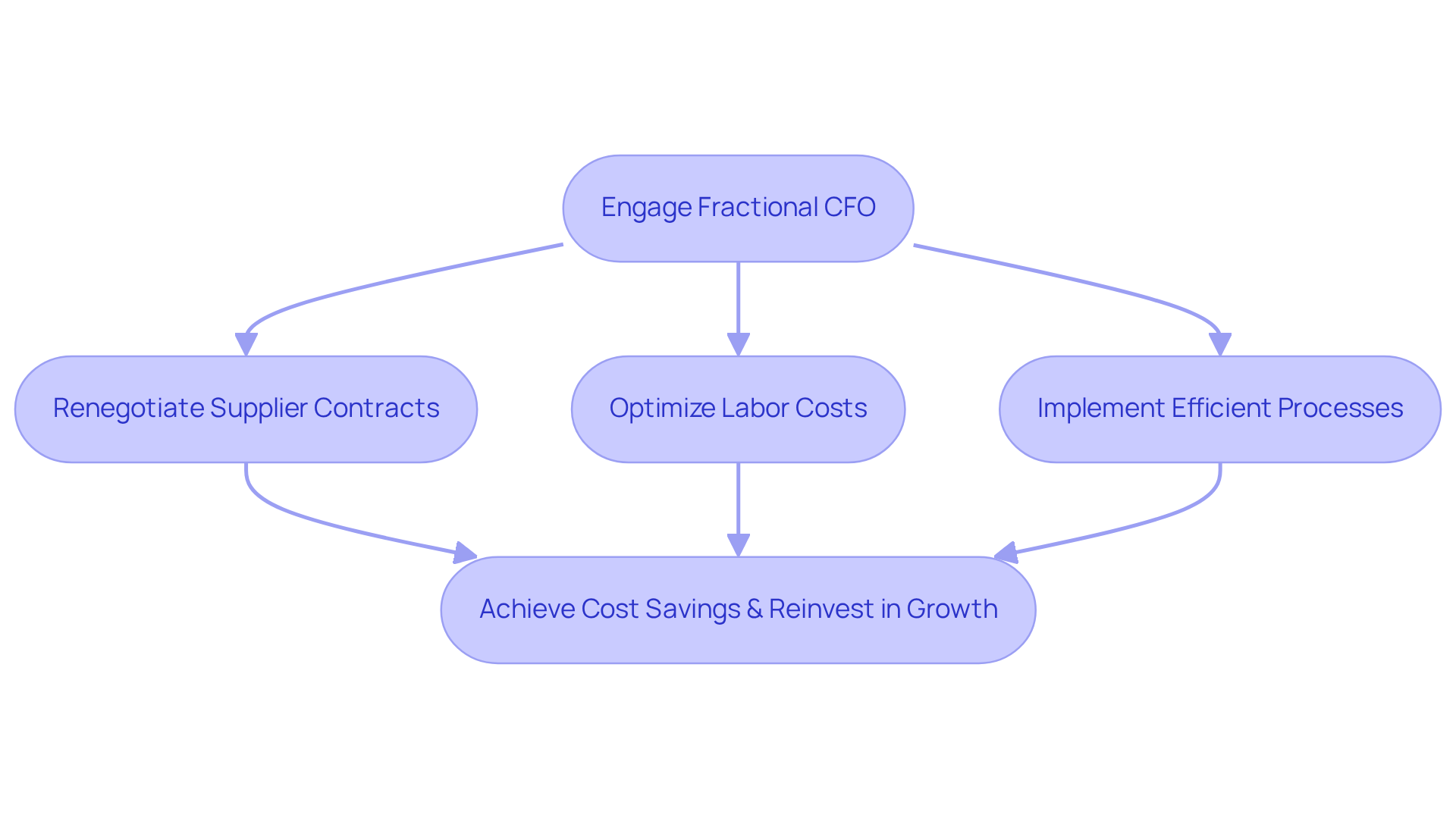

Achieve Cost Savings Through Fractional CFO Services

A fractional CFO for wine business possesses the expertise to conduct a comprehensive analysis of vineyard operations, identifying areas for cost reduction without compromising quality. This may entail:

- Renegotiating contracts with suppliers

- Optimizing labor costs

- Implementing more efficient processes

By realizing cost savings, businesses within the wine industry can bolster their bottom line and utilize a fractional CFO for wine business to reinvest in growth initiatives. Moreover, a fractional CFO for wine business can assist in developing and executing proven direct-to-consumer strategies that convert casual buyers into loyal club members, thereby driving predictable revenue and fostering customer loyalty. This strategic approach ensures that family-owned vineyards not only thrive in the present but also secure their future through meticulous capital planning.

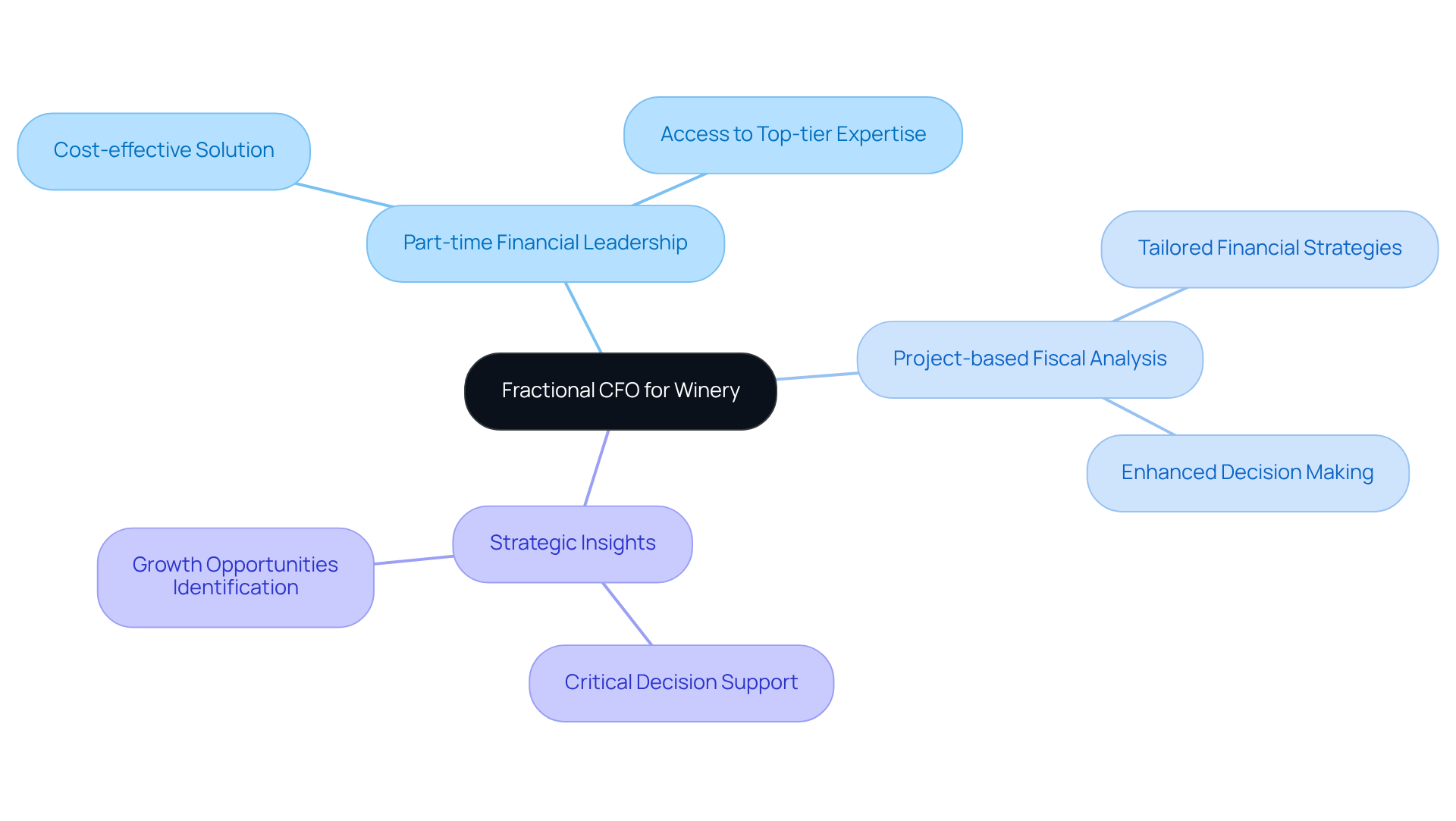

Leverage Flexible Financial Support for Your Winery

A fractional CFO for wine business delivers tailored fiscal assistance that meets the distinct needs of a vineyard. This service encompasses:

- Part-time financial leadership

- Project-based fiscal analysis

- Strategic insights during critical decision-making moments

By leveraging Enocap's comprehensive consulting services, vineyards can enhance their direct-to-consumer strategies, refine their brand narratives, and secure the necessary funding for expansion, achieving results such as a remarkable 191% increase in e-commerce sales. This approach allows vineyards to benefit from a fractional CFO for wine business, providing access to top-tier financial expertise without the commitment of a full-time employee, making it a cost-effective solution for many businesses.

Consider how integrating these services could transform your establishment's financial strategy and promote sustainable growth.

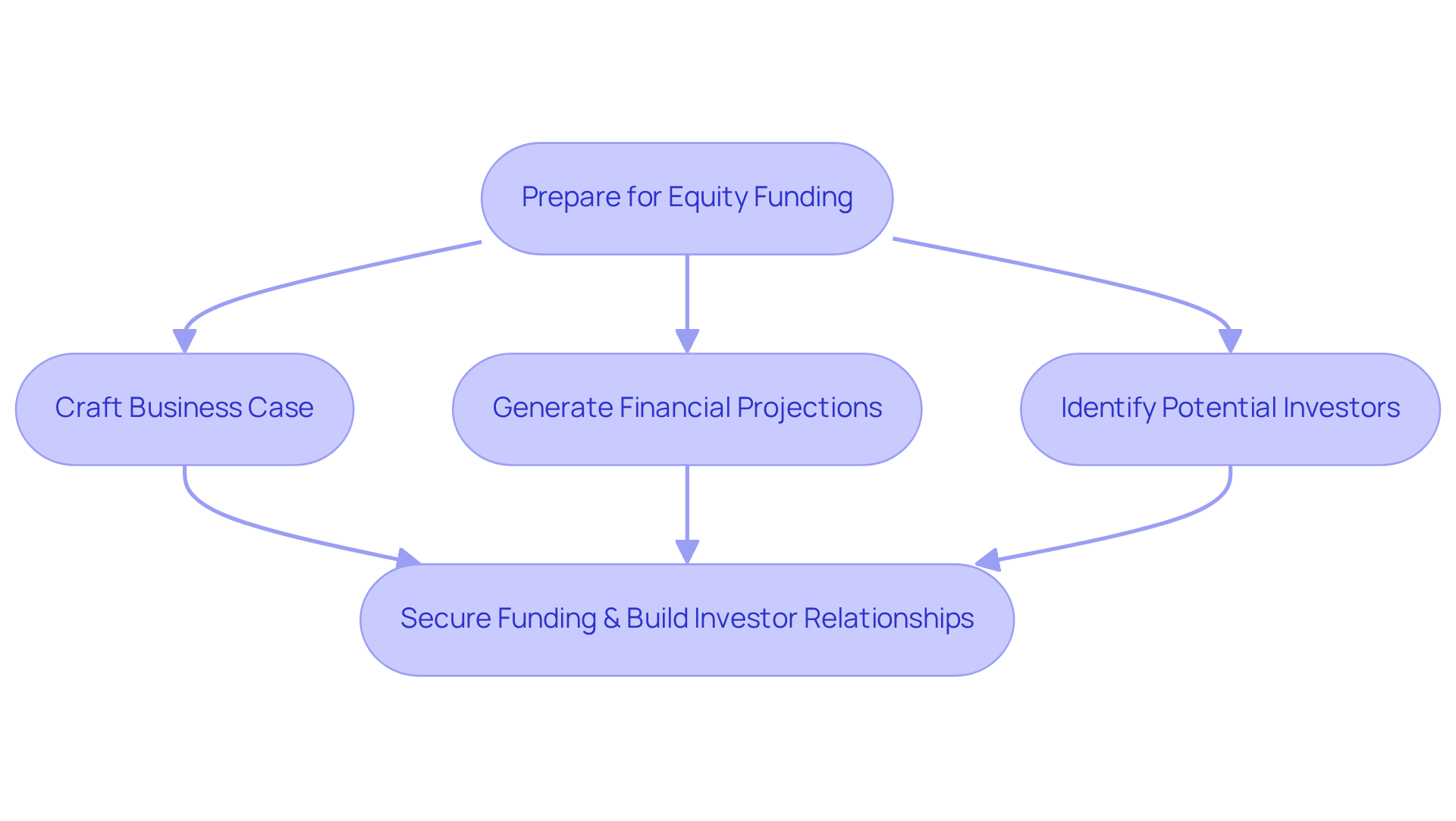

Facilitate Equity Funding for Business Expansion

A fractional CFO for wine business plays a pivotal role in helping vineyards prepare for equity funding. By:

- Crafting a compelling business case that articulates their unique narrative

- Generating precise financial projections

- Identifying potential investors

A fractional CFO for wine business positions vineyards for success. Leveraging their extensive network and expertise, they act as a fractional CFO for wine business, facilitating introductions to investors and guiding vineyards through the intricate fundraising process. This strategic approach to capital planning not only secures essential funding for expansion but also transforms casual buyers into committed club members through effective direct-to-consumer strategies. Furthermore, Enocap's consulting services enhance this process by tailoring solutions for debt, equity, and acquisition opportunities, ultimately unlocking significant expansion potential for family-owned vineyards.

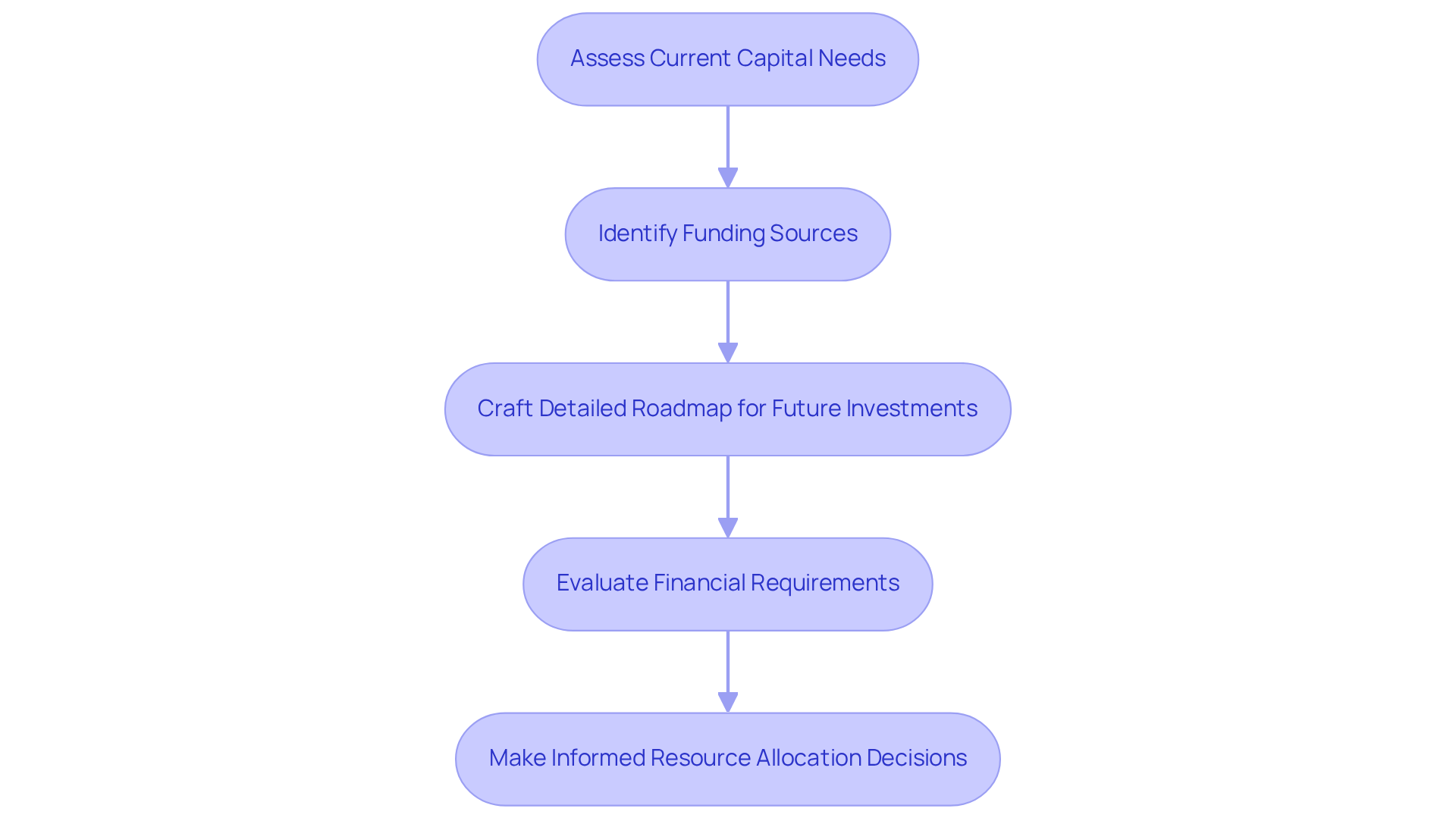

Engage in Strategic Capital Planning for Growth Opportunities

For vineyards aiming to develop a strategic capital plan aligned with their growth ambitions, a fractional CFO for wine business is indispensable. This role encompasses a comprehensive assessment of current capital needs, identifying potential funding sources—such as debt, equity, or acquisition opportunities—and crafting a detailed roadmap for future investments. In the highly competitive wine industry, where effective cash flow management is crucial, producers must proactively evaluate their financial requirements.

Engaging in strategic capital planning not only positions vineyards to seize growth opportunities but also equips them to navigate the complexities of funding their expansion efficiently. Financial advisors emphasize that understanding capital requirements is vital for sustainable growth, as it empowers businesses to make informed decisions regarding resource allocation and investment strategies.

By leveraging the expertise of a fractional CFO for wine business, wineries can enhance their financial resilience, ensuring they are well-prepared for the challenges and opportunities that lie ahead.

Conclusion

A fractional CFO possesses the power to significantly elevate a wine business, delivering specialized financial expertise and strategic insights that drive growth and enhance profitability. By concentrating on direct-to-consumer sales, optimizing wine club memberships, implementing effective demand generation techniques, and facilitating sound financial planning, vineyards can transform their operations and secure a sustainable future.

This article outlines several key strategies that a fractional CFO can employ to bolster a winery's performance. Enhancing e-commerce platforms and implementing targeted marketing campaigns are just a few insights that can lead to increased customer engagement and loyalty. Furthermore, effective cash flow management and strategic capital planning are crucial for navigating the complexities of the wine industry, ensuring that businesses can seize growth opportunities while maintaining financial stability.

Ultimately, engaging a fractional CFO offers wine producers a pathway to not only survive but thrive in a competitive landscape. By leveraging their expertise, vineyards can cultivate lasting relationships with customers, optimize their financial strategies, and position themselves for long-term success. Embracing these practices is essential for any winery aiming to harness the full potential of its operations and secure its legacy for generations to come.

Frequently Asked Questions

What role does a fractional CFO play in enhancing direct-to-consumer (DTC) sales for vineyards?

A fractional CFO helps vineyards identify and implement effective DTC sales strategies by analyzing customer data, optimizing e-commerce platforms, and enhancing customer engagement through personalized experiences.

How can vineyards increase customer loyalty and sales?

By tailoring marketing communications, vineyards can significantly increase customer loyalty and sales. A notable strategy is launching wine clubs or subscription services, which account for 39% of DTC sales.

What is the importance of email capture in e-commerce for wineries?

Effective email capture allows businesses to sell 78 cents online for every dollar sold in tasting rooms. In contrast, those with lower email capture rates only sell 18 cents, highlighting the need for a strong digital presence.

How do shipping costs affect e-commerce sales for vineyards?

Shipping costs significantly impact cart abandonment rates, making it crucial for vineyards to address these costs to optimize their e-commerce platforms.

What marketing strategies can enhance customer engagement for wineries?

Incorporating storytelling into marketing efforts and personalizing customer experiences can significantly enhance engagement and build loyalty among customers.

How can wineries optimize wine club memberships for increased loyalty?

Wineries can analyze membership data to identify trends and preferences, implement targeted marketing campaigns, and increase event frequency to boost member engagement and retention.

Why is financial modeling important for wine clubs?

Financial modeling helps predict income from wine clubs, allowing producers to prepare for sustainable growth and address cash flow challenges, especially during seasonal demand fluctuations.

What are effective demand generation techniques for vineyards?

Effective demand generation techniques include digital marketing, social media engagement, content marketing, and leveraging data analytics to evaluate marketing channel effectiveness.

How can personalized email campaigns impact sales?

Personalized email campaigns can achieve transaction rates six times higher than generic emails, making them a powerful tool for driving sales.

What benefits do micro-influencer partnerships provide for wine producers?

Micro-influencer partnerships help wine producers authentically connect with niche audiences, building trust and credibility, which can enhance brand visibility and customer loyalty.