Overview

This article presents a compelling comparison between Direct-to-Consumer (DTC) wine companies and traditional distribution models, underscoring the distinct advantages and challenges each approach faces in fostering growth within the wine industry.

DTC models not only enhance direct customer engagement but also yield higher profit margins. In contrast, traditional distribution methods provide broader market access, albeit often at the expense of brand connection and overall profitability.

It is imperative for wineries to strategically evaluate their distribution methods to thrive in an increasingly competitive landscape. By understanding these dynamics, industry stakeholders can make informed decisions that align with their growth objectives.

Introduction

The wine industry is experiencing a profound transformation as direct-to-consumer (DTC) companies challenge traditional distribution models. By forging direct relationships with consumers, DTC wine companies not only enhance brand loyalty but also cultivate deeper connections through personalized storytelling.

As this innovative approach gains momentum, critical questions emerge regarding the sustainability of DTC growth in comparison to established traditional distribution networks.

How can wineries adeptly navigate these contrasting pathways to secure enduring success in a rapidly evolving market?

Understanding DTC Wine Companies and Traditional Distribution Models

[DTC wine companies are revolutionizing the industry](https://enocap.com) by selling directly to consumers, effectively bypassing traditional distribution channels such as wholesalers and retailers. This innovative approach fosters a direct connection between producers and their customers, significantly enhancing brand loyalty and storytelling capabilities. Enocap excels in crafting engaging narratives that resonate with audiences, a critical component for nurturing brand loyalty. In 2021, the value of winery DTC sales soared to an impressive $4.2 billion, highlighting the increasing significance of this model in the wine sector.

Conversely, conventional distribution relies on a network of intermediaries, including distributors and retailers, to manage the logistics of delivering wine from producers to consumers. While this traditional model can provide broader market access, it often dilutes the brand's direct connection with consumers and incurs elevated costs due to multiple layers of distribution. For example, the average price per bottle surged by 11.8 percent in 2021, reflecting the escalating expenses associated with conventional distribution methods.

Understanding these fundamental differences is crucial for wine producers aiming to in today's competitive landscape. Successful DTC wine companies have demonstrated that prioritizing direct engagement with consumers not only drives immediate sales but also fosters long-term loyalty. Enocap's effective strategies for transforming casual buyers into dedicated club members underscore the importance of compelling brand storytelling and strategic capital planning for debt, equity, or acquisition opportunities. As the industry continues to evolve, adopting innovative strategies from DTC wine companies will be essential for producers seeking sustainable growth and a robust market presence.

Comparing Advantages and Disadvantages of DTC and Traditional Distribution

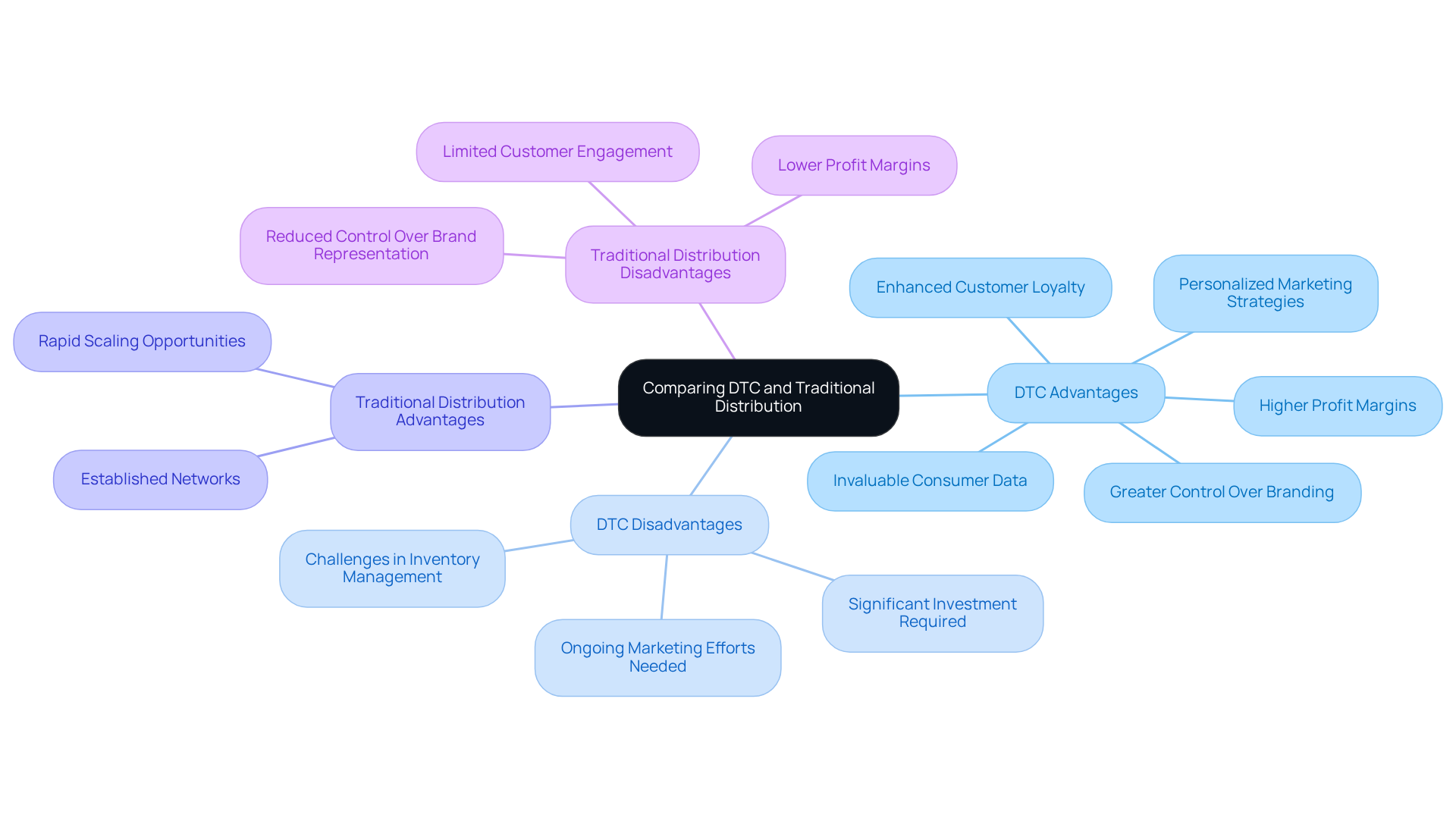

DTC wine companies experience significantly higher profit margins, often exceeding those of traditional distribution channels. This model empowers vineyards to exert greater control over their branding and customer experience, allowing for the collection of invaluable client data that informs tailored marketing strategies. Such direct engagement not only fosters customer loyalty but also encourages repeat purchases, which are essential for sustained success. However, adopting the DTC approach necessitates considerable investment in robust e-commerce platforms and effective marketing strategies, including SEO and social media outreach, to drive traffic and sales.

On the other hand, traditional distribution provides producers with established networks and market reach, facilitating rapid scaling. Yet, this model typically yields due to distributor fees and reduced control over brand representation. Wineries often struggle to cultivate direct connections with customers, which can hinder the development of long-term loyalty. As the wine industry evolves, comprehending these dynamics is crucial for wineries to navigate their growth strategies effectively.

As we approach 2025, the limitations of conventional distribution are becoming increasingly apparent, particularly as buyer preferences shift towards personalized experiences and direct interaction. Experts emphasize that while DTC sales can deliver immediate financial benefits, they also demand a commitment to ongoing marketing efforts and customer relationship management. Successful DTC marketing strategies frequently incorporate personalized communication, exclusive offers, and engaging content that resonates with consumers, thereby enhancing brand loyalty. Ultimately, vineyards must meticulously evaluate these factors to determine the most effective path forward in a competitive landscape.

Identifying Key Challenges in DTC and Traditional Distribution Strategies

DTC wine companies encounter significant challenges, particularly high customer acquisition costs and the necessity for ongoing engagement to foster customer loyalty. The complexity of managing logistics and fulfillment further complicates matters, as wineries must navigate shipping regulations and guarantee timely deliveries. In 2024, the direct-to-consumer (DTC) wine shipping channel experienced a 10% decline in shipments, highlighting broader industry challenges, including escalating logistics costs that threaten profitability.

In contrast, traditional distribution models grapple with their own set of issues. Dependence on third-party distributors often leads to reduced profit margins and a diminished control over the sales process. Wineries find it difficult to maintain across diverse retail outlets, which can dilute their market presence. For example, the 2025 Direct-to-Consumer Wine Shipping Report revealed that while DTC sales are anticipated to grow at a 5.4% CAGR over the next three years, traditional sales channels are projected to lag at a mere 1.9%.

Logistics experts underscore the necessity of streamlined fulfillment processes in DTC wine companies' sales. They note that vineyards must invest in robust logistics solutions to ship efficiently and comply with varying state regulations. As one logistics expert articulated, 'The ability to adapt to changing shipping laws and consumer preferences is vital for DTC wine companies looking to thrive in the market.' This adaptability is essential as vineyards strive to optimize their growth strategies in an increasingly competitive landscape.

Leveraging Strategic Planning and Customer Engagement for Growth

To thrive in the competitive wine market, producers must strategically plan by integrating insights from both DTC wine companies and traditional distribution. Enocap's comprehensive advisory services empower family-owned vineyards to propel direct-to-consumer growth for DTC wine companies through proven strategies that enhance brand narratives and secure essential capital.

Understanding market trends, consumer preferences, and the competitive landscape is paramount. Effective customer engagement strategies—such as:

- Personalized marketing

- Loyalty programs

- Compelling storytelling

can significantly bolster brand loyalty and drive sales. Wineries should also contemplate the integration of technology to streamline operations and , whether through e-commerce platforms or customer relationship management (CRM) systems.

By concentrating on these critical areas, wineries can strategically position themselves for sustainable growth and success in an ever-evolving market.

Conclusion

DTC wine companies are revolutionizing the wine industry by forging direct connections with consumers, thereby enhancing brand loyalty and storytelling. This innovative approach not only provides greater control over branding but also significantly boosts profit margins compared to traditional distribution models. As the market evolves, comprehending the dynamics between these two distribution methods is essential for producers aiming to thrive.

The article underscores the advantages and challenges encountered by both DTC and traditional distribution channels. DTC companies benefit from higher profit margins and the ability to engage directly with customers, while traditional distribution offers established networks, often at the cost of brand dilution and reduced profitability. As consumer preferences increasingly shift towards personalized experiences, the necessity for wineries to adapt their strategies becomes critical.

Ultimately, the wine industry stands at a pivotal crossroads where strategic planning and effective customer engagement are paramount. By leveraging insights from both distribution models and investing in technology and marketing, wineries can position themselves for sustainable growth. Embracing the evolving trends in wine distribution will not only enhance profitability but also foster lasting connections with consumers, paving the way for a more resilient future in the competitive wine market.

Frequently Asked Questions

What are DTC wine companies?

DTC wine companies sell wine directly to consumers, bypassing traditional distribution channels such as wholesalers and retailers, which enhances the connection between producers and their customers.

How does DTC sales impact brand loyalty?

DTC sales foster a direct relationship between producers and consumers, significantly enhancing brand loyalty and allowing for more effective storytelling.

What was the value of winery DTC sales in 2021?

In 2021, the value of winery DTC sales reached $4.2 billion, indicating the growing importance of this model in the wine industry.

What is the traditional distribution model for wine?

The traditional distribution model relies on a network of intermediaries, including distributors and retailers, to manage logistics and deliver wine from producers to consumers.

What are the drawbacks of traditional distribution methods?

Traditional distribution can dilute the brand's direct connection with consumers and incurs higher costs due to multiple layers of distribution, leading to an increase in the average price per bottle.

How much did the average price per bottle increase in 2021?

The average price per bottle surged by 11.8 percent in 2021, reflecting the rising expenses associated with conventional distribution methods.

Why is it important for wine producers to understand the differences between DTC and traditional distribution?

Understanding these differences is crucial for wine producers to evaluate the effectiveness of each method in a competitive landscape and to make informed decisions about their sales strategies.

What strategies do successful DTC wine companies use?

Successful DTC wine companies prioritize direct engagement with consumers, compelling brand storytelling, and strategic capital planning to transform casual buyers into loyal club members.

What should wine producers consider for sustainable growth?

As the industry evolves, wine producers should adopt innovative strategies from DTC wine companies to achieve sustainable growth and maintain a strong market presence.