Overview

This article presents essential insights for achieving success in global wine operations. It underscores the significance of:

- Direct-to-consumer strategies

- Efficient supply chain management

- The integration of technology and storytelling

These elements are crucial for enhancing customer engagement and driving sales in a competitive marketplace. By focusing on these strategies, wine producers can effectively navigate the complexities of the market and establish a strong connection with their consumers.

Introduction

The global wine industry is experiencing a transformative shift, as family-owned wineries increasingly embrace innovative strategies to excel in a competitive marketplace. With the expansion of direct-to-consumer (DTC) sales channels, these vineyards are harnessing the power of personalized marketing and compelling storytelling to cultivate deeper connections with consumers. Yet, amid the promise of growth, wineries confront significant challenges, including fluctuating costs, regulatory compliance, and evolving consumer preferences.

How can these establishments not only navigate these complexities but also leverage them for sustainable success? This article delves into ten key insights designed to empower wineries to optimize their operations and enhance their market presence in 2025 and beyond.

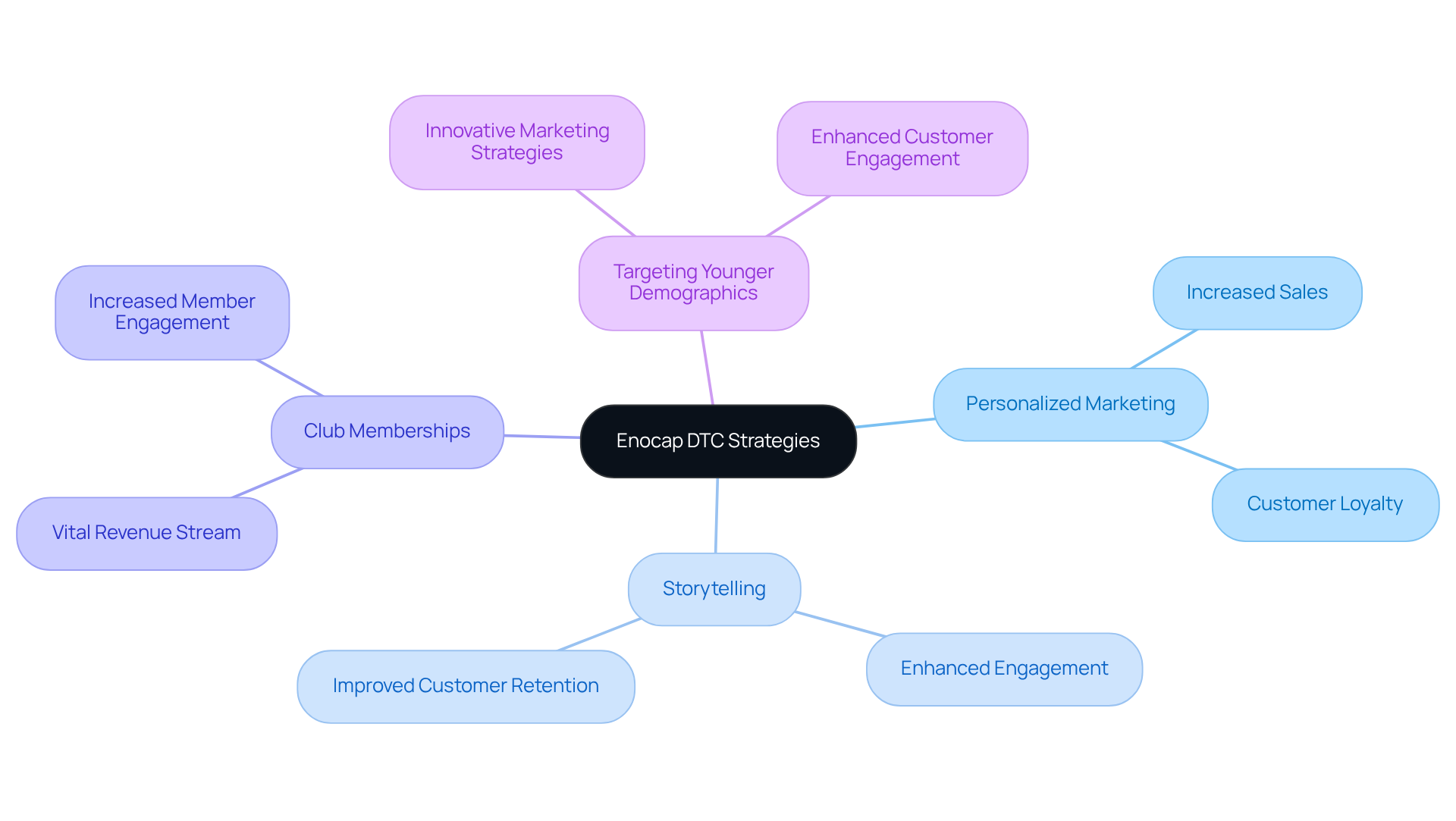

Enocap: Transforming DTC Strategies for Family-Owned Wineries

Enocap stands at the forefront of developing direct-to-consumer (DTC) strategies, empowering family-owned vineyards to forge deeper connections with their customers. By emphasizing personalized marketing and engaging storytelling, Enocap equips vineyards to craft compelling narratives that resonate with consumers, leading to substantial increases in sales and fostering long-term loyalty. This strategy proves particularly effective, as vineyards that embrace storytelling witness notable improvements in customer retention and satisfaction.

The company's initiatives focus on enhancing club memberships, which have emerged as a vital revenue stream, alongside implementing demand generation techniques essential for sustainable growth in today's competitive landscape. Wineries that have adopted targeting younger demographics report enhanced customer engagement and increased sales through clubs and online platforms.

Furthermore, the average price per bottle shipped in DTC sales has risen to $52.68, underscoring a growing consumer preference for quality and personalized experiences. This trend accentuates the importance of storytelling in beverage marketing, as consumers gravitate towards brands that offer unique narratives and authentic connections. Enocap's commitment to these elements not only propels immediate sales growth but also nurtures a loyal customer base, ensuring that family-owned wineries flourish in the ever-evolving marketplace.

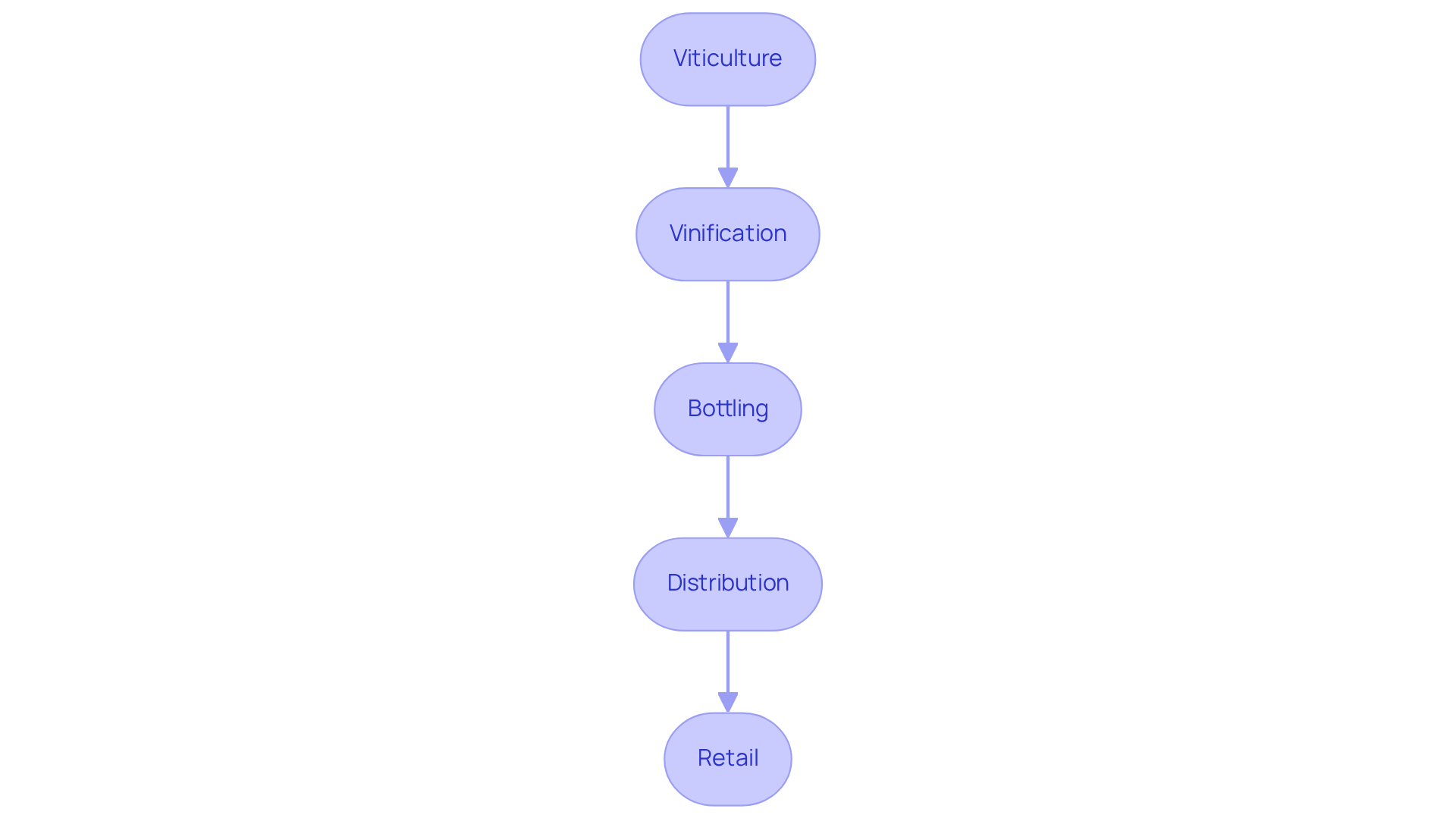

Key Stages of the Wine Supply Chain: From Viticulture to Retail

The beverage supply chain is comprised of several critical stages:

- Viticulture (grape growing)

- Vinification (beverage production)

- Bottling

- Distribution

- Retail

Each stage presents distinct challenges and opportunities that can significantly influence the overall quality and success of the beverage. Efficient viticulture methods are crucial, as they directly enhance grape quality, which is essential for crafting outstanding beverages. For example, the application of advanced canopy management techniques can improve sunlight exposure and increase the concentration of flavor compounds in grapes, resulting in superior quality beverages.

Furthermore, streamlined distribution processes are vital for minimizing costs and enhancing delivery times, ensuring that wines arrive at consumers in optimal condition. Industry leaders underscore the necessity for wine producers to embrace innovative practices, such as precision viticulture, which leverages data analytics to monitor vineyard conditions and make informed decisions that elevate grape quality.

Nonetheless, challenges persist within both viticulture and vinification. Factors such as climate variability, pest management, and soil health can adversely affect grape yield and quality. Successful vineyards are those that proactively address these challenges through and continuous learning. By grasping the intricacies of each stage in the supply chain, producers can pinpoint inefficiencies and implement targeted improvements, ultimately enhancing their market competitiveness and consumer satisfaction.

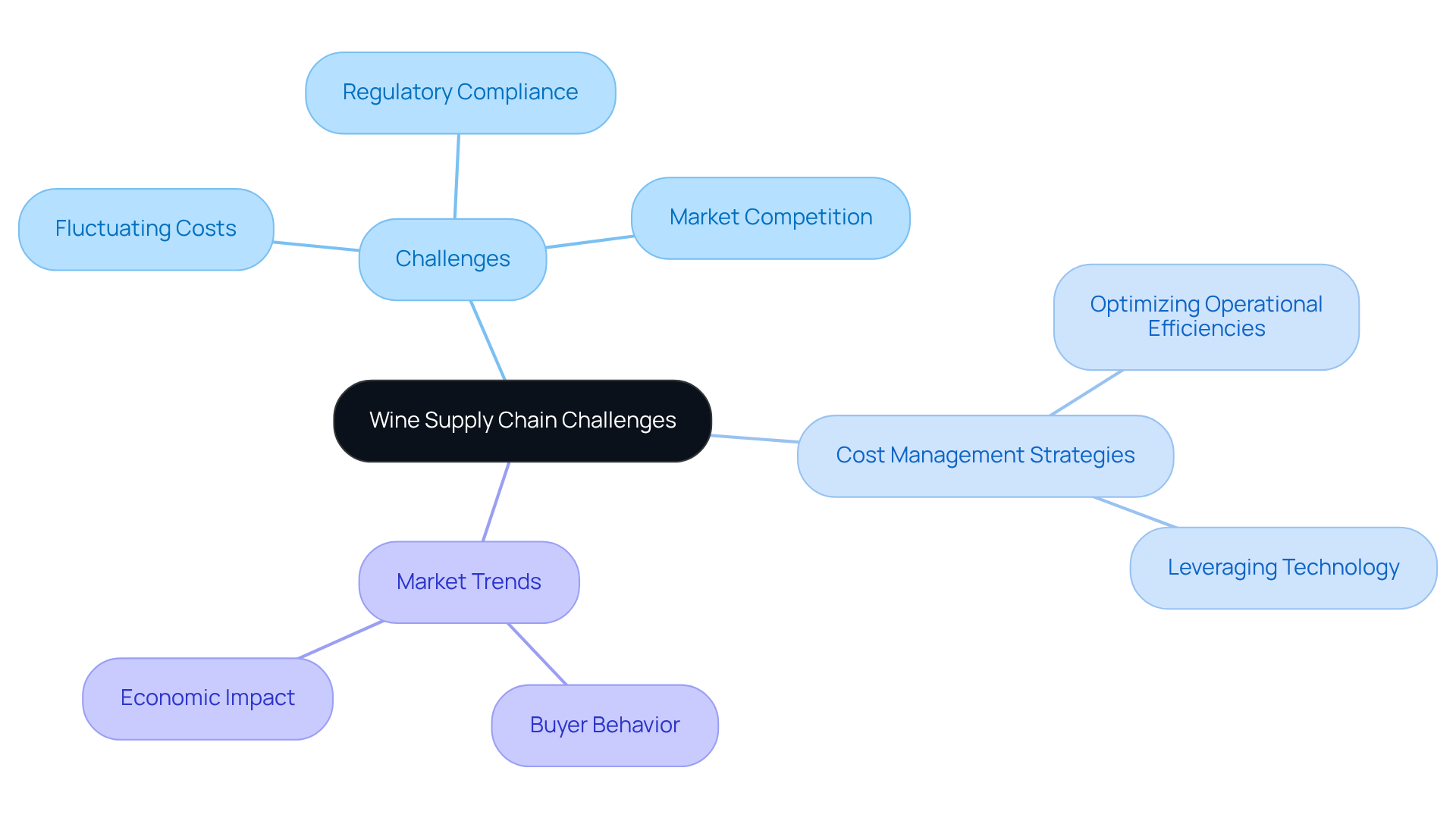

Challenges in the Wine Supply Chain: Navigating Costs and Regulations

Wineries encounter substantial challenges due to fluctuating costs, regulatory compliance, and fierce market competition. The evolving landscape of local and international regulations demands that producers remain vigilant and adaptable. Compliance has become a pressing concern, with costs associated with meeting these requirements escalating rapidly. Bill Robertson, CIO of De Bortoli Wines, articulates that compliance can serve as both a challenge and an opportunity, stating, "If you can meet these requirements effectively, you gain a competitive edge."

To navigate these complexities, vineyards must adopt robust cost management strategies. This includes:

- Optimizing operational efficiencies

- Leveraging technology to streamline processes

For example, the modernization of data capture systems at Laithwaites resulted in a notable reduction in warehouse errors and enhanced productivity, illustrating how technology can bolster compliance and operational resilience.

Furthermore, the wine industry is witnessing a shift in buyer behavior, with younger consumers increasingly prioritizing transparency and ethical practices. This trend compels producers not only to comply with regulations but also to engage in authentic brand storytelling to resonate with consumers. As wineries adapt to these changes, they can mitigate risks and position themselves for sustainable growth in a competitive marketplace.

In 2025, the anticipated economic impact of the beverage sector is projected to exceed $323 billion, underscoring its significance as a key economic driver. However, the introduction of tariffs and regulatory complexities may impose an estimated $0.75 to $1 billion in additional costs annually for U.S. imports from the EU, further complicating the operational landscape. Wineries must remain proactive in their approach to compliance and to thrive amidst these challenges.

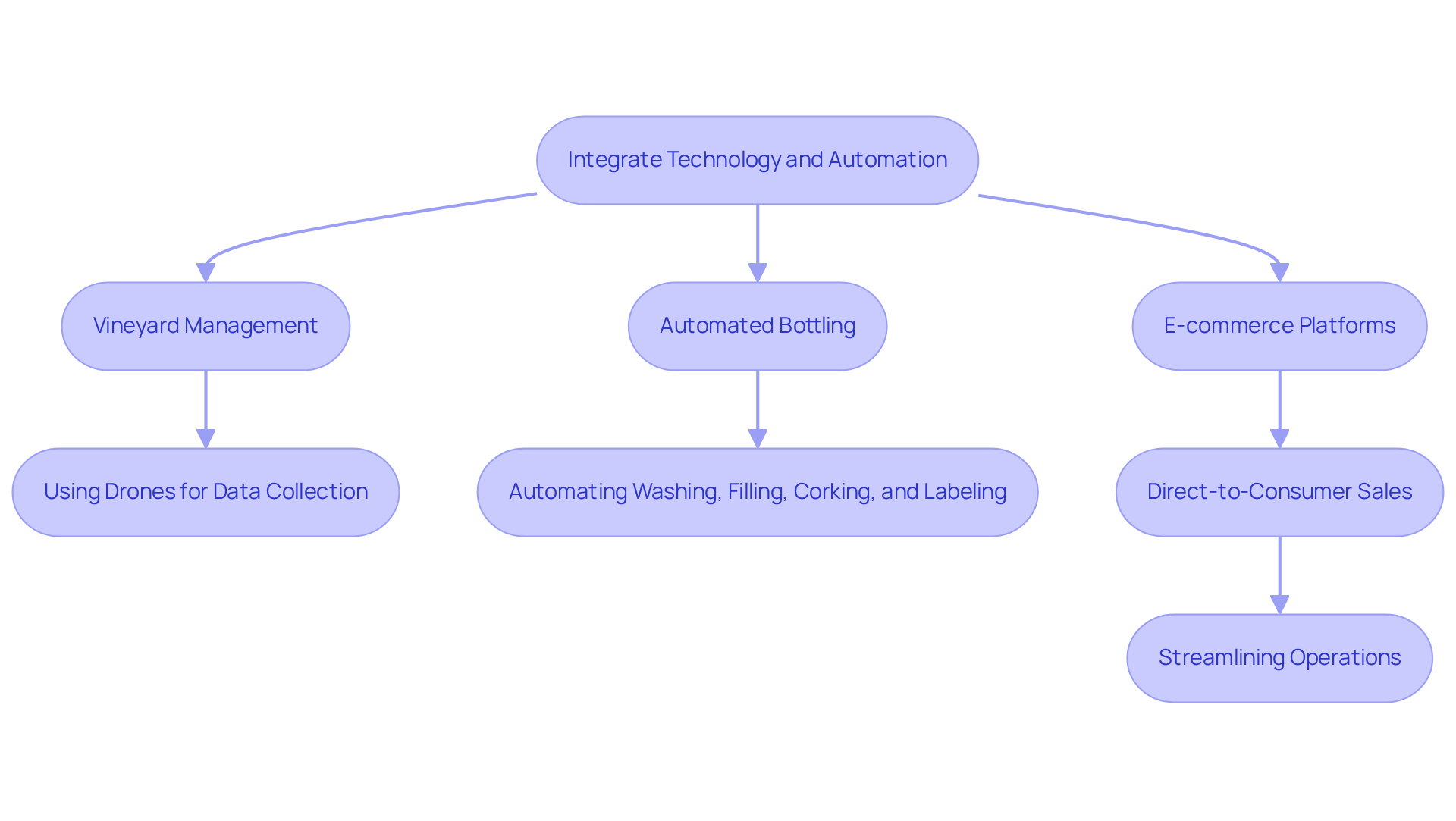

Implement Technology and Automation: Streamlining Wine Operations

Integrating technology and automation into global wine operations is not just beneficial; it is essential for enhancing efficiency and reducing costs across various processes, from vineyard management to sales. Tools such as vineyard management software, , and e-commerce platforms play a pivotal role in streamlining operations and establishing sustainable direct-to-consumer channels that drive consistent growth.

For example, modern bottling lines automate the processes of washing, filling, corking, and labeling. This automation significantly increases efficiency, reduces labor costs per bottle, and minimizes waste, all contributing to a lower cost of goods sold.

Furthermore, precision viticulture technologies, including drones equipped with multispectral cameras and IoT sensors, provide real-time data on moisture levels and pest infestations. This enables optimized irrigation and targeted fertilization, enhancing grape quality and boosting revenue.

Establishments utilizing these technologies have successfully transformed casual buyers into loyal club members through effective brand storytelling. By adopting these advancements, establishments can prioritize quality and customer engagement in their global wine operations, leading to improved operational performance and stronger financial health.

The shift towards automation is not merely a trend; it signifies a strategic investment in the future of wine production. This ensures that family-owned establishments remain competitive in an evolving market while effectively securing the right capital for growth.

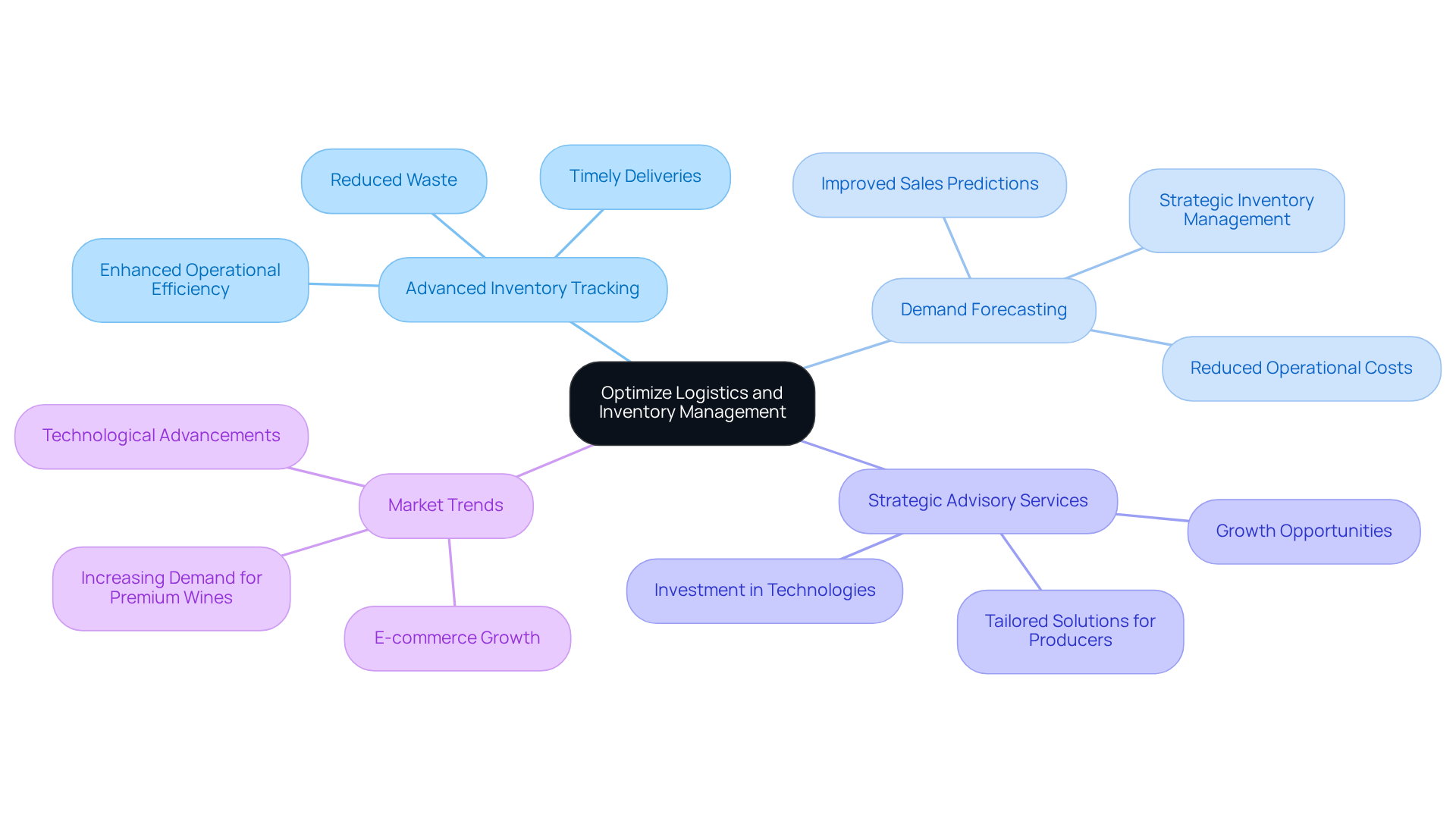

Optimize Logistics and Inventory Management: Enhancing Efficiency

Optimizing is crucial for vineyards involved in global wine operations to maintain a competitive edge in an evolving market. Advanced inventory tracking systems not only reduce waste but also ensure timely deliveries—an essential factor for global wine operations given the delicate nature of wine. Establishments employing real-time monitoring and data analysis have reported enhanced operational efficiency and decreased spoilage rates.

By analyzing sales data and consumer trends, producers can significantly improve their demand forecasting capabilities in global wine operations, leading to more strategic inventory management and reduced operational costs. Case studies reveal that vineyards involved in global wine operations and adopting these systems have seen a remarkable boost in efficiency, with some reporting up to a 30% decrease in surplus inventory.

Enocap's strategic capital advisory services can further bolster these efforts, unlocking growth opportunities through tailored debt, equity, and acquisition solutions that enable wine producers to invest in advanced logistics technologies. With the global wine operations expected to expand at a CAGR of 4.2% through 2033, incorporating efficient inventory management practices—alongside Enocap's direct-to-consumer approaches—will be vital for producers to seize emerging opportunities and tackle marketplace challenges.

Industry experts assert that adopting best practices in inventory management can yield significant improvements in operational efficiency.

Strengthen Direct-to-Consumer Sales: Boosting Winery Revenue

To enhance revenue, wineries must fortify their . Enocap's proven strategies are instrumental in establishing sustainable direct-to-consumer channels that facilitate consistent growth. This can be achieved through:

- Targeted marketing strategies

- Personalized customer interactions

- Enticing club offerings that transform casual purchasers into loyal members

By nurturing direct connections with buyers, vineyards can not only elevate sales but also foster brand loyalty and enhance customer retention, thereby ensuring that family-owned vineyards thrive for generations.

Use Data for Decision-Making: Adapting to Market Dynamics

In the rapidly evolving wine industry, leveraging consumer behavior data is essential for producers aiming to maintain competitiveness and uncover growth opportunities. By analyzing purchasing habits, preferences, and market trends, vineyards can tailor their strategies to effectively meet customer needs. For instance, the adoption of AI technologies is on the rise, enabling the analysis of e-commerce and point-of-sale data. This allows vineyards to identify emerging consumer segments and accurately forecast future demand.

Current trends reveal that vineyards are increasingly utilizing data analytics tools to refine their marketing strategies and enhance operational efficiencies. A prime example is Cupcake Vineyards, which harnessed machine learning technology to optimize its 'Summer of Joy' campaign, resulting in a notable boost in engagement and sales. This strategy not only sharpened their audience targeting but also facilitated adaptation to the evolving preferences of wine consumers, who are increasingly gravitating towards premium selections.

Experts underscore the critical role of consumer behavior analysis in shaping vineyard strategies. Zane Stevens, a leading financial consultant for vineyards, asserts that understanding and leveraging AI’s predictive capabilities is vital for a vineyard's future. He notes, "Precise demand forecasting is a game-changer for financial planning," reinforcing the notion that AI can help vineyards avoid the pitfalls of overproduction and underproduction while strategically planning for debt, equity, or acquisition opportunities. Enocap plays an integral role in this landscape, offering strategic capital advisory services that empower family-owned vineyards to secure the funding necessary for success.

As vineyards navigate the complexities of the market, integrating buyer behavior insights into decision-making processes will prove indispensable. By adopting data-driven strategies, wine producers can boost their operational effectiveness and cultivate deeper connections with consumers through compelling brand storytelling. To thrive in a competitive environment, wineries should consider collaborating with like Enocap to unlock growth opportunities and secure the capital essential for sustainable development.

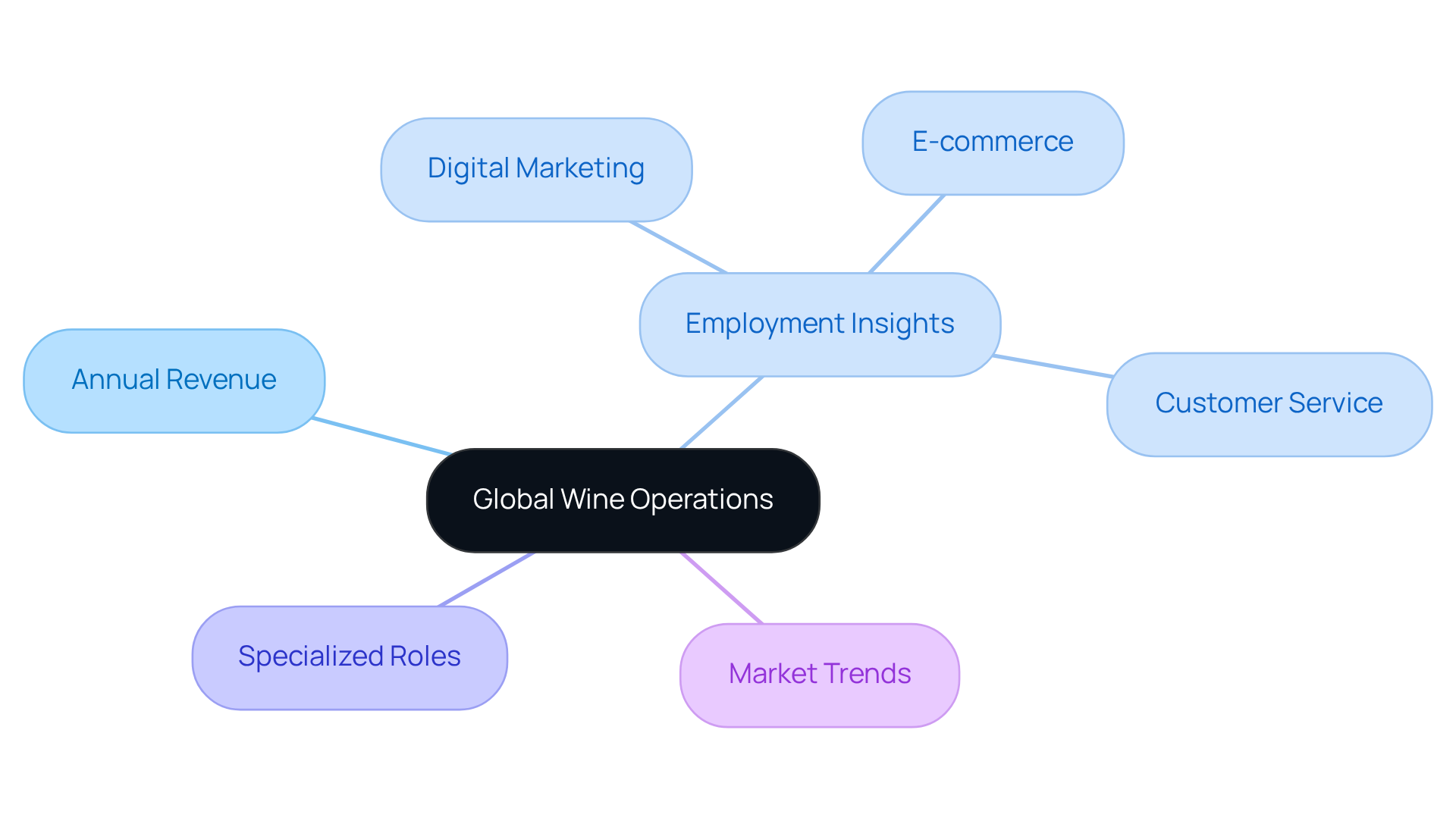

Global Wine Operations: Annual Revenue and Employment Insights

The global beverage industry stands as a formidable powerhouse, generating substantial annual revenue and employing millions across various sectors. By 2025, employment trends indicate a shift towards more specialized roles, reflecting the industry's adaptation to evolving buyer preferences and market demands. The emergence of direct-to-consumer sales channels has opened new job opportunities in marketing, e-commerce, and customer service, highlighting the necessity for skilled professionals adept at navigating these dynamic environments.

Recent statistics underscore the increasing competitiveness of the beverage sector's employment landscape, marked by a significant rise in positions tied to digital marketing and data analytics. This transformation is propelled by producers' imperative to bolster their online presence and effectively engage with consumers. Noteworthy case studies, such as the success of in the UK, exemplify how the implementation of innovative platforms like Wine Hub has streamlined operations and expanded their workforce to meet surging demand.

Furthermore, insights from industry experts accentuate the critical need to comprehend employment trends for maintaining competitiveness. For example, the Napa Valley grape cluster has thrived by fostering a culture of innovation among local vintners, resulting in job creation and economic development in the region. As producers continue to adapt to market fluctuations, remaining informed about employment statistics and trends will be vital for strategic planning and operational success.

In conclusion, the global wine industry's employment landscape is evolving, with an emphasis on specialized roles that drive growth and innovation. By leveraging insights from Enocap's strategic capital advisory services, including tailored debt, equity, and acquisition solutions, businesses can strategically position themselves in the marketplace and seize emerging opportunities.

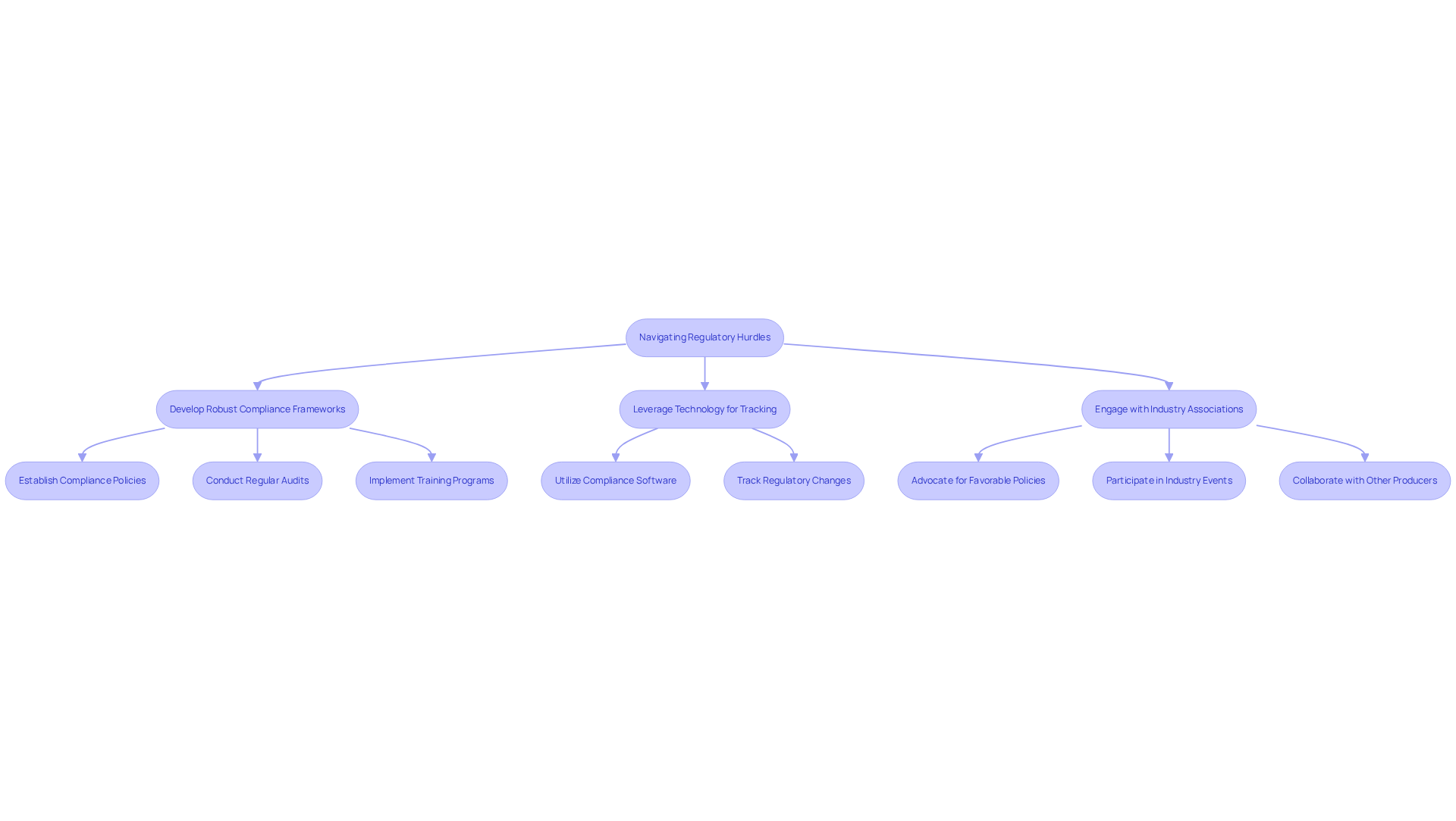

Navigate Regulatory Hurdles: Ensuring Compliance in Wine Operations

Navigating regulatory hurdles is essential for wineries seeking to thrive in a complex marketplace. Compliance with local, state, and federal regulations regarding production, labeling, and distribution is not merely a legal obligation; it is a strategic necessity. As of January 10, 2025, new regulations will introduce 13 additional container sizes for beverages, including options like 180 milliliters and 2.25 liters. This change allows producers to cater to diverse consumer preferences and potentially reduce production costs, enhancing profitability while aligning offerings with market needs—a crucial element of Enocap's advisory services, which include demand generation techniques and wine club optimization.

Wineries must remain vigilant about these to avoid legal pitfalls and maintain a positive brand image. Effective strategies for navigating the regulatory landscape encompass:

- Developing robust compliance frameworks

- Leveraging technology for tracking and reporting

- Engaging with industry associations that advocate for favorable policies

For instance, WineAmerica emphasizes the importance of a user-friendly regulatory framework, supporting modifications that benefit both producers and buyers.

Moreover, understanding the implications of federal legislation, such as the USPS Shipping Equity Act, is vital. This act aims to permit the USPS to deliver alcoholic beverages directly to consumers, addressing the increasing demand for direct-to-consumer shipments of such products, particularly in the aftermath of the pandemic. Such changes could significantly influence distribution methods and market entry for wine producers, underscoring the necessity for effective capital planning and strategic collaborations, as highlighted by Enocap's services.

In summary, producers that proactively implement compliance strategies and adapt to regulatory changes will be better positioned to succeed in the competitive beverage industry. By fostering a culture of adherence and remaining engaged with legislative changes, wine producers can effectively navigate the complexities of production and distribution. Furthermore, it is advisable for vineyards to familiarize themselves with the new container dimensions and compliance standards to enhance their market positioning while being mindful of potential customer confusion regarding the introduction of various container sizes.

Enhance Brand Storytelling: Connecting with Wine Consumers

Improving brand narratives is essential for vineyards aiming to forge strong emotional connections with customers. By articulating their history, values, and the unique qualities of their products, these establishments can resonate with individuals on a personal level. This not only differentiates them from competitors but also fosters loyalty, prompting repeat purchases.

For instance, research indicates that 66% of U.S. shoppers prefer eco-friendly beverages, often influenced by the stories of small-scale farmers linked to the products. Moreover, vineyards that adeptly communicate their heritage and sustainable practices can cultivate trust and authenticity, rendering wine selections more personal.

Successful examples include establishments that provide immersive wine-tasting experiences, allowing patrons to engage directly with the brand's narrative. Given that emotional connections significantly impact consumer loyalty, wineries that prioritize storytelling are strategically positioned to excel in a competitive market.

Conclusion

The success of global wine operations hinges on a multifaceted approach that integrates innovative strategies, efficient supply chain management, and a deep understanding of consumer preferences. Family-owned wineries, in particular, can thrive by embracing direct-to-consumer models that prioritize personalized marketing and compelling storytelling. This not only enhances customer engagement but also fosters long-term loyalty, ensuring that these establishments remain competitive in a challenging market.

Key insights from the article highlight the importance of:

- Optimizing logistics

- Leveraging technology

- Navigating regulatory complexities

By implementing robust inventory management systems and embracing automation, wineries can significantly reduce costs, improve operational efficiency, and enhance product quality. Additionally, understanding the evolving landscape of consumer behavior and regulatory requirements is crucial for sustainable growth.

As the wine industry continues to evolve, it is imperative for producers to stay informed and adaptable. Collaborating with strategic advisory services like Enocap can unlock new growth opportunities and provide the necessary capital to invest in innovative practices. Ultimately, by prioritizing data-driven decision-making and enhancing brand narratives, wineries can connect more deeply with consumers, ensuring their success in the dynamic global wine market.

Frequently Asked Questions

What is Enocap and what role does it play for family-owned wineries?

Enocap is a company that develops direct-to-consumer (DTC) strategies to help family-owned vineyards connect more deeply with their customers through personalized marketing and engaging storytelling.

How does storytelling impact customer retention in wineries?

Wineries that embrace storytelling see notable improvements in customer retention and satisfaction, as compelling narratives resonate with consumers and foster long-term loyalty.

What revenue stream is emphasized by Enocap for family-owned wineries?

Enocap focuses on enhancing club memberships, which have become a vital revenue stream for family-owned wineries.

How are younger demographics influencing winery marketing strategies?

Wineries targeting younger demographics report enhanced customer engagement and increased sales through clubs and online platforms.

What is the average price per bottle shipped in DTC sales?

The average price per bottle shipped in DTC sales has risen to $52.68, indicating a growing consumer preference for quality and personalized experiences.

What are the key stages of the wine supply chain?

The key stages of the wine supply chain include viticulture (grape growing), vinification (beverage production), bottling, distribution, and retail.

What challenges do wineries face in the supply chain?

Wineries face challenges such as fluctuating costs, regulatory compliance, climate variability, pest management, and soil health.

How can wineries improve grape quality during viticulture?

Efficient viticulture methods, such as advanced canopy management techniques, can enhance grape quality by improving sunlight exposure and increasing flavor concentration.

What is the significance of compliance in the wine industry?

Compliance with local and international regulations is crucial for wineries, as it can be both a challenge and an opportunity that affects operational costs and competitive advantage.

What strategies can wineries adopt to navigate cost challenges?

Wineries can optimize operational efficiencies and leverage technology to streamline processes, which can help manage costs and enhance productivity.

How is buyer behavior changing in the wine industry?

Younger consumers are increasingly prioritizing transparency and ethical practices, prompting wineries to engage in authentic brand storytelling and comply with regulations.

What is the projected economic impact of the beverage sector by 2025?

The beverage sector's economic impact is projected to exceed $323 billion by 2025, highlighting its significance as a key economic driver.

What potential costs could U.S. wineries face due to tariffs and regulatory complexities?

U.S. wineries may face an estimated $0.75 to $1 billion in additional costs annually due to tariffs and regulatory complexities associated with imports from the EU.